The Scientific Research and Experimental Development (SR&ED) program allows your company to obtain a tax credit of up to 65% of your expenses related to an eligible project carried out during a fiscal year.

This program is a federal government initiative, but most provinces offer their own credits in addition to those offered by the Canadian government. It is aimed at companies conducting innovative research and development.

Which companies are covered by SR&ED?

SR&ED is particularly attractive for Canadian-controlled private corporations (CCPCs), since they benefit from a higher rate.

There are no restrictions on the sectors in which companies can apply for SR&ED. In fact, companies in any sector can take advantage of the credit as long as the project meets the program’s eligibility criteria. While companies operating in sectors more naturally associated with research and development, such as pharmaceuticals or IT, obviously benefit from the credit, other companies in sectors less linked to SR&ED have been able to take advantage of the credit. For example, companies in the tourism and insurance sectors have obtained a tax credit thanks to the projects they have carried out. So it’s the project that determines a company’s eligibility, not its core business.

What projects are eligible for SR&ED?

Firstly, eligible projects must be carried out in Canada. They can be grouped into three categories:

- Pure research: this type of project has no practical application in view. The main aim of this kind of project is scientific advancement on some subject.

- Applied research: very similar to pure research, this type of project has a practical application in view.

- Experimental development: this is the most common type of project eligible for SR&ED. The aim is to develop new products or improve existing ones. The project must still include an innovative element, i.e. the new product or product improvement does not already exist on the market.

It is important to note that commercial benefits are not mentioned in any of the categories. In fact, a project’s actual or anticipated commercial spin-offs are not taken into consideration when determining a project’s eligibility.

An eligible project must therefore meet two requirements. The work must be carried out with a view to scientific or technological advancement and involve research through experimentation or analysis.

In concrete terms, eligible projects are attempts to solve a problem for which there is no ready solution on the market. This is where the “research” aspect of the project comes into play. Through experimentation or analysis, a company develops tentative solutions to their problem. The discoveries made during the research phase can then constitute one or more advancements. On the other hand, a breakthrough is not necessarily having found the solution to the initial problem. The success of the project is therefore not taken into account when determining its eligibility. It is therefore essential to demonstrate that the project represents a step forward, whether through product development or the deepening of knowledge.

In addition, some work that is not in itself eligible under the program becomes eligible when carried out in support of the main project. These include engineering, design, operations research, mathematical analysis, computer programming, data collection, testing and psychological research.

What expenses are eligible for SR&ED?

Eligible expenses are those directly linked to the realization of the project. These include the salaries of employees involved in the project, contracts with subcontractors, materials and so on. However, certain conditions apply. As far as employee salaries are concerned, only the portion corresponding to the time spent by employees on the project is eligible. For example, $30,000 will be eligible for an employee with an annual salary of $60,000 who has spent 50% of his or her time working on the project and on support work. For subcontractor contracts, it is important that the subcontractor be established in Canada, otherwise the entire expense is not eligible. Finally, material expenses are fully eligible, as long as they are incurred solely for the purposes of the project.

How is credit calculated?

On the federal side, the credit rate is 35% for CCPCs of $3M or less. Added to this is the provincial credit, which in Quebec is 30%. However, this 30% does not apply to the first $50,000 in expenses.

There are two ways of calculating the tax credit: the traditional method and the alternative method. In addition to the eligible expenses mentioned above, under the traditional method, general expenses, i.e. any other expenses incurred directly as a result of the project, are eligible. In other words, expenses that are not salary, contractual or material-related, but which would not have been incurred without the project.

Demonstrating the eligibility of these overheads can be rather difficult, however, and in many cases these expenses are difficult to account for. This is why the replacement method is used in the vast majority of cases. Overheads are not eligible under this method, as they are “replaced” by an amount corresponding to 55% of eligible payroll expenses.

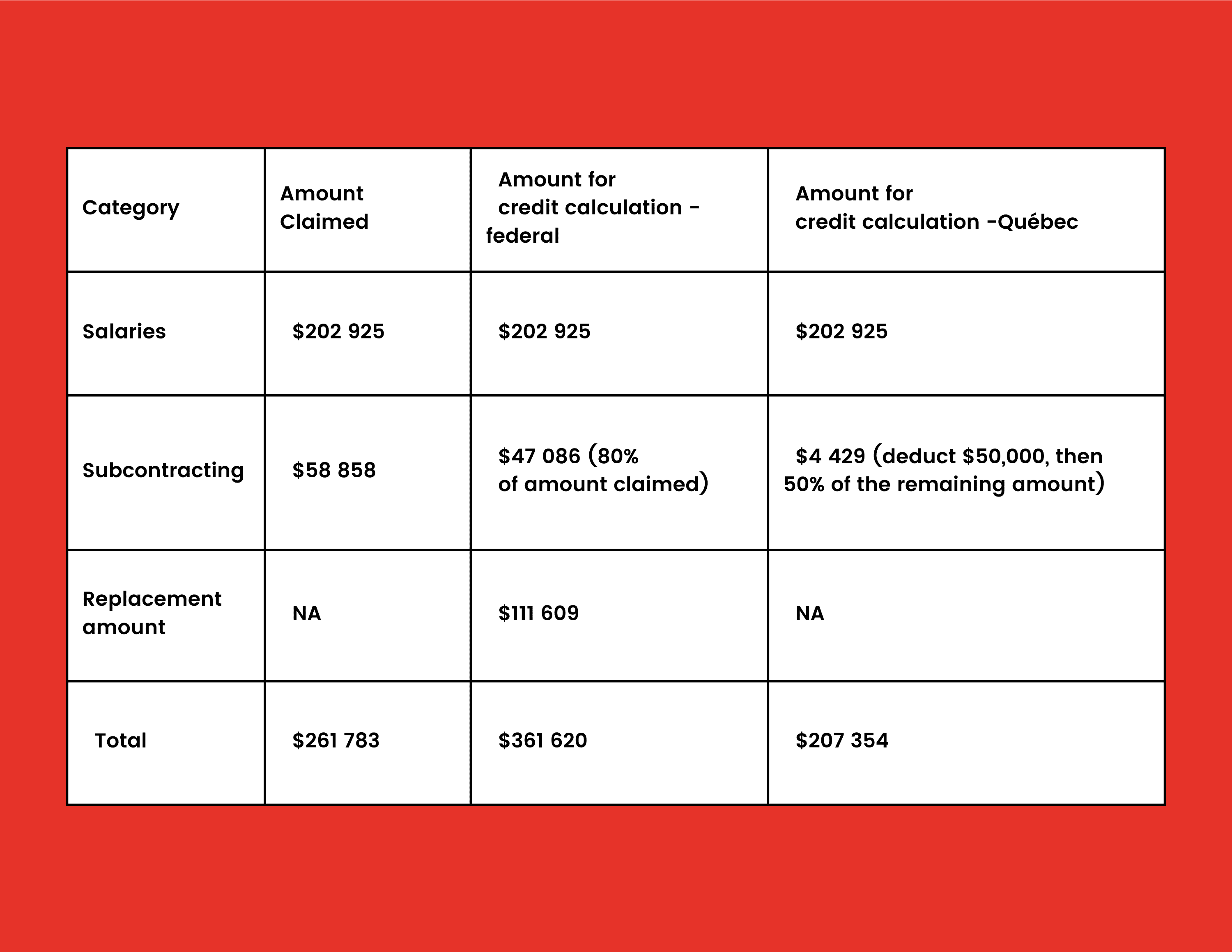

There are a number of peculiarities to the calculation of certain eligible amounts. For expenditure on subcontracting, 80% of the amount claimed is taken into account in calculating the credit.

The tax credit is therefore 35% on the first $50,000, then 65% on the remaining expenses.

Case study

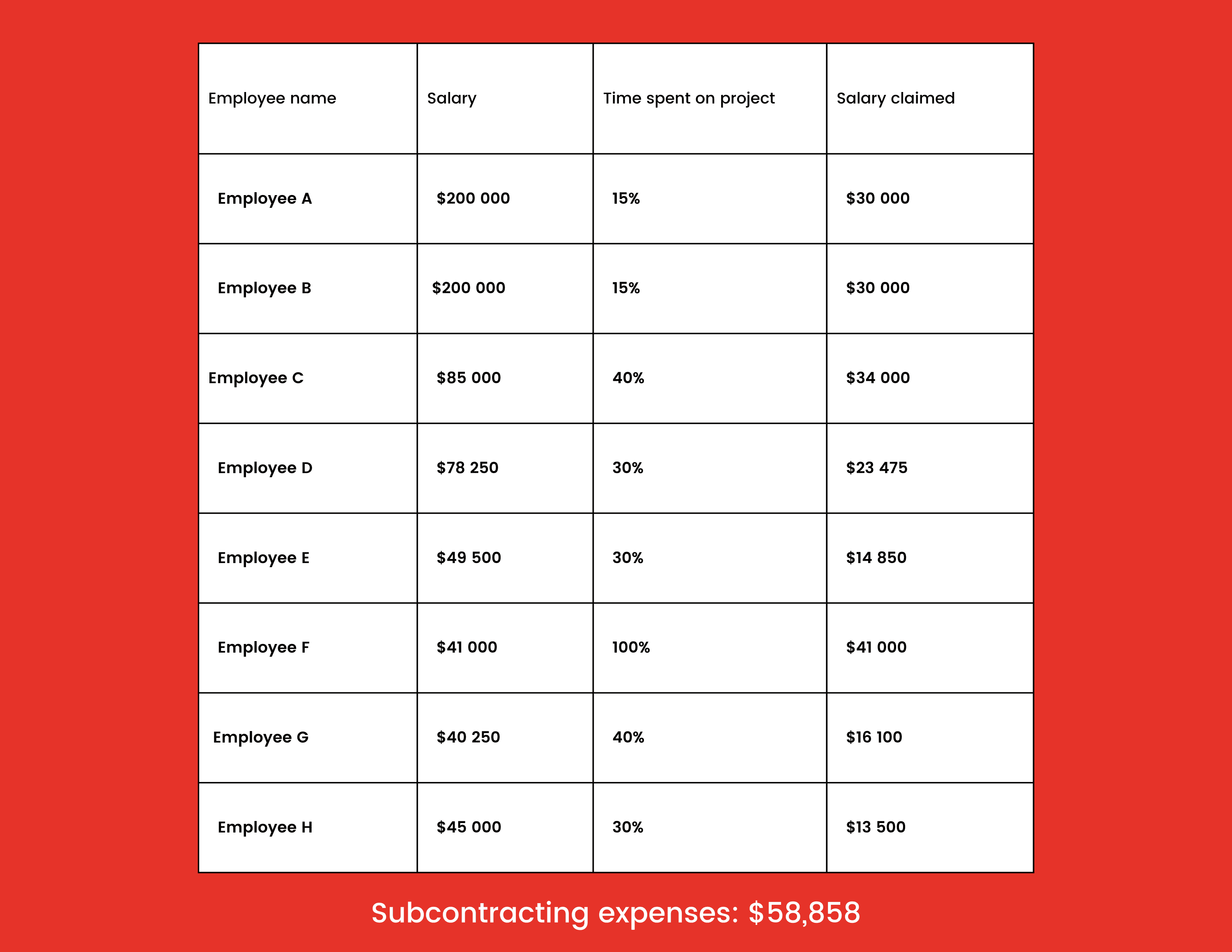

Company ABC worked on an SR&ED project during the last fiscal year and incurred the following expenses.

Subcontracting expenses: $58,858

Credit calculation

The provincial government credit is first calculated at a rate of 30% on the amount of $207,354, giving a credit of $62,206. Note that the provincial credit is deducted from the amount used in the federal calculation, which means that the federal credit is calculated at a rate of 35% on $299,414, resulting in a tax credit of $104,795.

Overall, the credit obtained is therefore $167,001 on expenses of $261,783, representing a credit of approximately 64%.

What is expected of the applicant?

The SR&ED application requires a written section in addition to the various forms on which expenses are entered. In fact, the written part requires an explanation of the uncertainties and challenges encountered at the outset and during the course of the project, the means used to overcome these uncertainties, and the results of all the experimentation. All documentation forms part of the company’s federal and provincial tax return, and is therefore submitted at the end of the company’s fiscal year.

At Propulsio, we are specialized and equipped to write complete claims that meet federal and provincial government expectations, maximizing your chances of success. If you think you’ve completed an SR&ED-eligible project, or if you have any questions, please don’t hesitate to contact us at info@propulsio360.com or book an exploratory call with us below: